There are now more than +1400 carbon removal companies around the world. Every one of them is working toward the same goal as we are: removing hundreds of millions of tonnes of carbon dioxide from the atmosphere. This is the space race of the 21st century but mistakes and learnings will be made along the way to achieve that goal. Which means our job at CUR8 is to support corporates on their carbon removal journey while identifying and minimising the risks. Many of these companies are very early in their progress. Many of them are working on scientific approaches that are still essentially experimental. And the hard truth is that - like in any other emerging industry - in several years many of them will no longer exist.

So how do de-risk net zero for corporates, protect their investments yet fuel the most needed innovation? Over the next decade, there has to be a massive increase of capital that flows from those that produce emissions to those that can remove emissions. The buyers that understand the need for carbon removal early on and are willing to invest in it are paving the way. But for them to successfully set the example for other potential carbon removal buyers, the credits they buy now have to truly work. Those credits have to be delivered on time, in full, and without negative social or environmental impacts. Each of them has to represent a tonne of carbon dioxide removed from the air and stored for hundreds to thousands of years. And even the carbon that has already been removed and stored can sometimes be hard to verify; it’s harder still to assess the tonnes that need to be delivered in the future, when we commit to multi-year offtake agreements.

It’s our job to make sure of these things. In order to have complete faith in the credits we provide, our science team evaluates every carbon removal project through our proprietary 100-point diligence framework which we’ve spent the last two years optimising. This enables us to feed new and updated data back into our system to continuously learn and improve. That framework is broken down into five categories that represent the high-level questions that we see as most critical.

Here are the five categories in our diligence framework

1. Impact

This is where we ask the most fundamental question: What is the actual climate impact of a project? How fast is carbon being removed? How permanent is the storage? And, above all, for every credit delivered is a tonne of carbon truly being removed from the atmosphere?

A project might physically remove a tonne of carbon from the atmosphere – but the intervention might lead to more carbon being released elsewhere. There could be emissions that take place during the process that aren’t properly accounted for. There could be problems with additionality – in other words, the project could do what it says it’s going to do, but it might be an intervention that would have happened anyway, even if no one bought the credits. There could also be basic uncertainties in the method itself, if it’s a novel one. We ensure that credits from the projects we choose will deliver the desired impact and represent a full tonne of CO2 removed from the atmosphere.

2. Integrity

The best projects address every one of the above issues rigorously and transparently. That’s what Integrity means in our framework: all the things that a supplier can do to make sure that their carbon outcomes are accurately quantified, tracked, and communicated. All of the critical elements of MRV (Measurement, Reporting and Verification) live in this category, as well as the basics of accreditation and carbon accounting. Under Impact, we assess the total risk that a claimed tonne of carbon removal might actually be less than a tonne. Under Integrity, we ask whether the supplier is doing everything they can to minimise that risk.

3. Delivery Risk

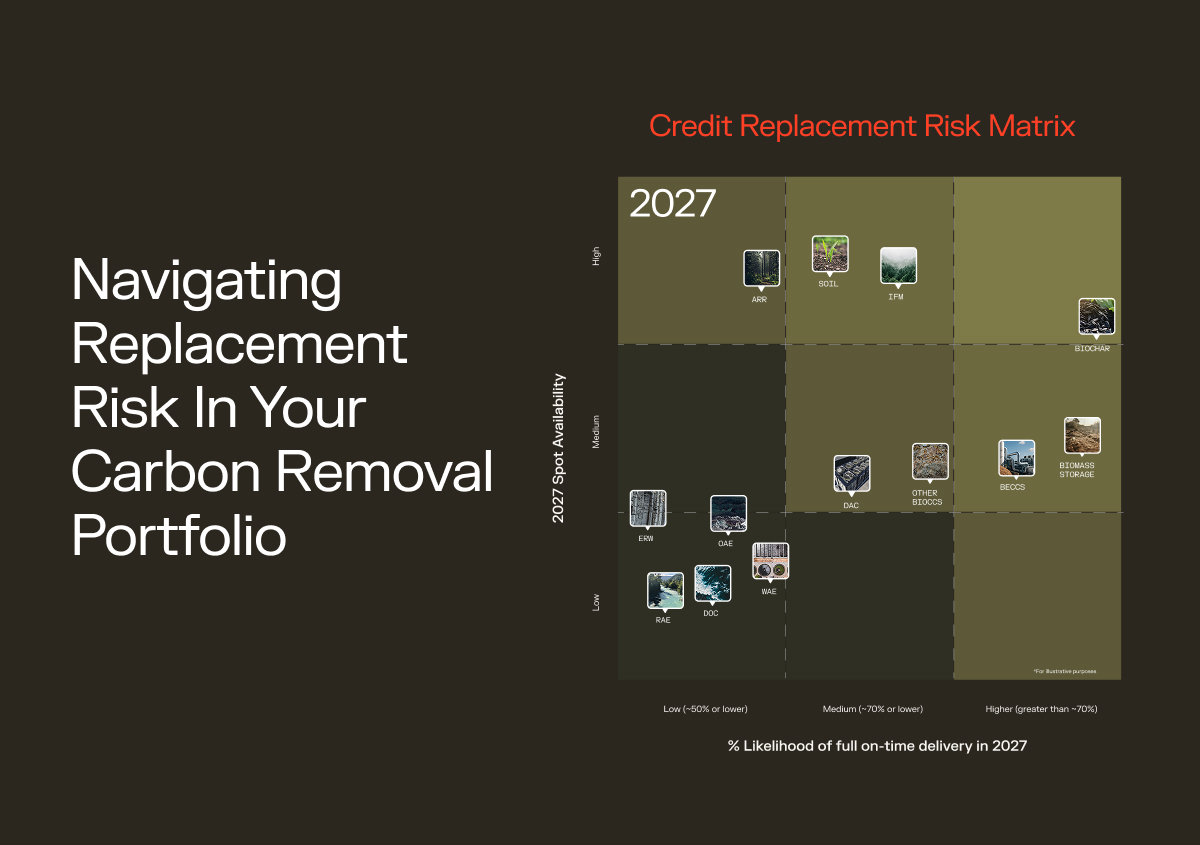

The risks in the Impact section are risks to the atmosphere — they’re independent from whether or not credits are actually delivered to the buyer. The Delivery Risk category is an assessment of whether or not the credits themselves will be delivered in full and on time.

In some cases there’s no risk here – obviously, tonnes that were removed last year don’t carry delivery risk. But the most important transactions in the carbon removal industry are long-term offtakes, where a corporate buyer commits to purchasing credits every year for the next, say, 5 years. Between now and then, there are many things that could change. Just as banks or VCs conduct their due diligence when considering loans or investments, we assess the likelihood of a project succeeding to deliver on all of its promises.

These risks can come from inside the company; or, more likely, they’re external risks. Many projects will face steep regulatory headwinds, or have an over reliance on partners of various kinds. Geo-political instability, climate change, weather patterns – all of these vary across locations and project types and need to be assessed.

4. Beyond Carbon

If we’re going to meet our climate goals, then in the next few decades carbon removal needs to become a global endeavour that reaches the same scale as today’s oil and gas industry. Any industry at that scale poses social, economic, and environmental risks. In the case of carbon removal, especially for those methods that directly involve ecosystems, there’s also vast potential for ecological co-benefits. The Beyond Carbon category is an assessment of these critical aspects of carbon removal projects: What are the social and economic risks and benefits? Projects that aren’t preserving ecosystems, food webs, biodiversity, and the strength and resilience of local communities are not going to be good candidates for carbon removal at scale.

5. Future Potential

We see all the work we do through the lens of this huge requirement for scaling. The carbon removal industry today is orders of magnitude smaller than it needs to be. The main constraint it faces is capital. As a company whose role it is to channel capital across the industry, we have to be absolutely certain that those resources are going to the companies and technologies that are most likely to be driving gigaton-scale removal in a decade.

In the Future Potential category, we make sure that we’re not allocating capital to projects that will only deliver credits now, without also laying the groundwork for much larger projects to come. At the scale most of the industry is currently operating at, individual carbon credit purchases don’t make much of a dent in overall atmospheric CO2 levels. What does make a difference is the momentum created by bringing buyers on board, the example they set through their early carbon removal purchases, and ensuring that the capital they bring to the table is truly catalytic.

We’re not in the business of telling our clients that purchasing carbon removal poses no risk. We’re in the business of reassuring them that we’re the best at identifying, anticipating and managing risks as they come our way. There is no net zero without carbon removal, so if you’d like to de-risk your net zero future, get in touch.

November 22, 2024

.png)

.jpg)